“Oh, it’s vintage”

“I found it at a thrift store”

“I got it on the RealReal”

All of a sudden, it seems like everyone you know is buying resale. And, well, it’s kind of true. The second-hand fashion market is on a steep upwards trajectory - spend across resale apparel, accessories, and footwear actually outpaced traditional retail spend in 20241. Peer-to-peer marketplaces, like Ebay and Depop, aren’t new, but they are experiencing a resurgence as the masses flock to resale as an equally viable alternative to shopping new. Why buy that full priced Reformation wedding guest dress when you can get it once-worn and 50% off?

Some people have the patience to dig and hunt on these resale sites. I am not one of those people. Unless I’m looking for a very specific item, the consumer experience scrolling through photos of clothes haphazardly laid out on a bed or crooked on a hanger is not for me. You’re given a generic sentence on the item and rarely shared details about the quality or fabric composition.

And don’t get me started on selling. Unless you’re running a resale side hustle, selling on these peer-to-peer marketplaces is time intensive and rarely worth dollars you pocket at the end of the day. I usually end up taking that stack of clothes sitting on my dresser for 3 months down to the donation shop.

Maybe I’m just an impatient person that has trust issues with buying resale on the internet, but if I were able to buy resale directly from a brand I already trust - knowing the product has been vetted for quality - I would happily pay a slight premium, than risking it on user1267.

And positioning themselves as a layer of trust and authenticity is exactly where we are seeing brands start to enter the resale chat.

Brand resale models

I first learnt that Zara has its own resale program (yes, you read that right) via Danielle Copperman’s instagram story. Of all brands, why is Zara in the resale space? How are they making the consumer value proposition and business economics work? And who else is already expanding into this market?

Well, it seems like there are three primary resale business models that brands have started to adopt:

Owned: Brands “buy” back & resell directly to consumers

We see this model used by Lululemon and Dôen, where they take your gently worn merchandise in exchange for store credit. Are you getting cold, hard cash in your pocket? No. But assuming you’re a loyal customer to that brand, you just got free money to shop (that’s how girl math works). I love this because it’s effectively a loyalty program, ultimately driving consumers increasing spend on new product, while the brand also gets to capitalize on resale. SMART.

Lululemon operates Like New as a separate website that consumers can shop year-round. Honestly, I’m not sure if I would buy resale athletic wear, but what surprises me about Lululemon being in this market is it feels highly cannibalistic to their existing business. A legging is a legging, right? My hypothesis is that Lululemon’s resale channels allows them to acquire customers who wouldn’t normally spend $120 USD on Lululemon leggings, providing a pathway to upsell from “Like New” gear to net new retail in the future.

In contrast to Lululemon’s site, which is shopable year-round, you can only buy resale from Dôen during Flash Sales2 they announce throughout the year.

Hand Me Dôen claims these limited time resale periods are so they can cultivate a large enough collection of preloved items for consumers to have a good shopping experience. And while that might have some truth to it, I really think it’s a strategy to control how frequently Dôen shoppers are buying preloved vs. full price, new items.

Peer-to-Peer: Brands operate peer-to-peer marketplaces

Brands, including Zara, are operating peer-to-peer marketplaces. At first, I was pretty shocked this was a viable business model. How could this be any different than shopping on Depop or Shopbop? To my surprise, the experience on Zara’s pre-loved marketplace blew me away.

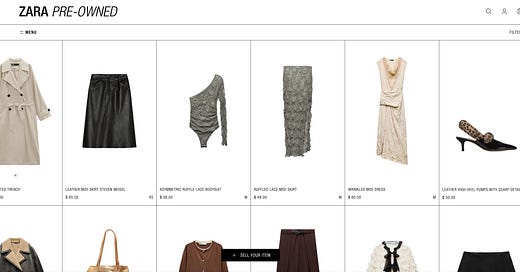

Shopping for Zara on Depop looks like this:

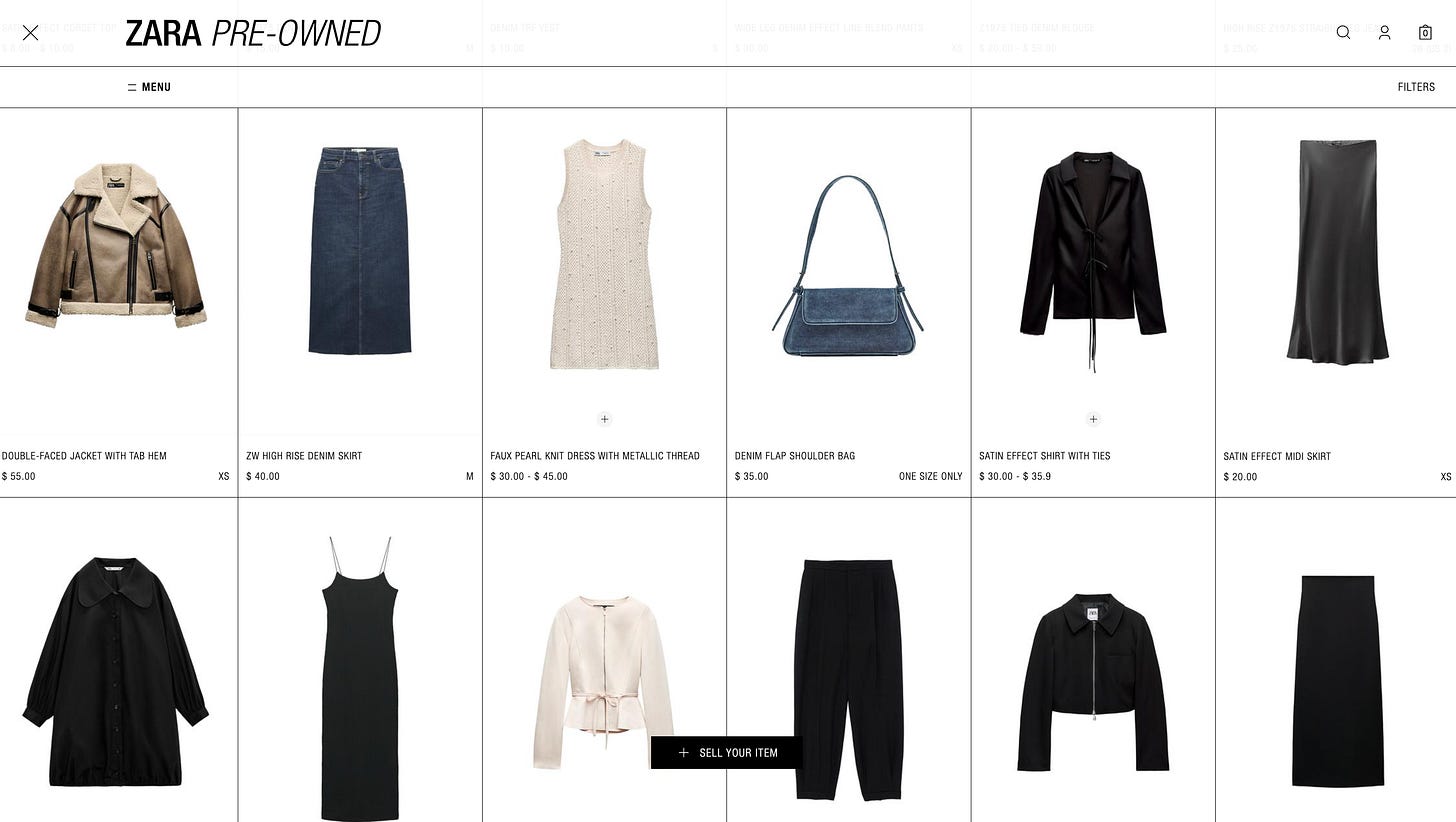

As expected: inconsistent imagery and minimal product details. In contrast, Zara’s second hand shopping experience looks like this:

An experience that is almost 100% identical to shopping on their website.

As a seller, you are required to scan the item’s barcode when uploading. This enables Zara to pull all of the relevant details - including the garment name, year of make, fabric composition, and original item photography - which is then used to create a superior resale consumer shopping experience.

The other feature I loved: if multiple sellers are selling the same item, it shows up under one listing and when you click in you can see the multiple listings and price points side-by-side.

Damn, that’s sleek.

Hybrid: Brands running peer-to-peer and brand-direct resale

Galia Lahav, operates Re: Galia which is a marketplace that has both peer-to-peer and brand-direct preloved garments. It runs like a peer-to-peer marketplace where Galia Lahav is one of the sellers.

I was initially surprised to see a luxury brand leaning into an owned resale channel. However, the once-wear nature of the bridal industry makes resale of a luxury product more palatable - you’re targeting consumers with a very specific occasion-based use-case, which likely aids in new customer acquisition. In contrast, if The Row or Chanel had brand-owned resale marketplaces, I do think it would significantly impact their brand value.

As a brand direct seller, Galia Lahav can now monetize on samples or floor models by putting them on this resale marketplace. And as a consumer, whether you’re buying from Galia or a peer, you have assurance that the item has been vetted by the brand, adding an additional layer of trust - which is even more important for a high ticket priced item.

Market Outlook

Most retailers who operate brand-direct, peer-to-peer, or hybrid marketplaces aren’t building or operating these resale market solutions themselves, but outsourcing the work to companies like Trove and Treet who manage all of the logistics and operations.

With companies building easy-to-execute solutions for brands, I think we’ll continue to see more entrants in this category. While each type of resale model has value, I do think brands with the following characteristics will be best positioned to capitalize in the segment:

Contemporary brands. Think brands like Reformation, Dôen, and Sézane who cater to consumers looking for quality without high-end luxury pricing. With a thoughtful strategy, I believe these brands can capitalize on resale without diminishing their brand value in the market

Specialty brands. Evening-wear, bridal, or resort are examples of specialty brand categories that have a once or a few-time wear use case. They are the types of product you want to rotate in your wardrobe, and as such, face less risk for brand dilution or sales cannibalization

Bespoke product selection. Differentiation between new and resale products will be critical to minimize cannibalization. Brands that operate a drop model or follow a seasonal retail model (where they do not frequently restock SKUs) will offer a much stronger value proposition for consumers.

Are you surprised that retailers are moving into resale? And which brands do you think will succeed launching resale operations? Send me a DM or drop a note below, would love to hear your thoughts.

Fashion Dive; Apparel resale growth outpaced retail in 2024: report

I am a long-time shopper of resale it took me an even looooonger time to get over seeing stuff photographed poorly. I feel like so many people are smarting up to adding a photo from a website of their item as the showcase image. Anyways, that makes Zara's offering that much more interesting because you can see the object 1st as the brand wants and 2nd as the seller cares. I'm fascinated to see how much Zara invests in this space as sustainability doesn't seem like a genuine care of theirs BUT I look forward to them changing my mind!

Great resale breakdown! Zara's recommerce reminds me of Girlfriend Collective's P2P utilizing hybrid brand and user imagery to make the user journey more visually appealing while delivering preloved product credibility. I appreciate that Zara's offering a more elevated resale experience, but I've been curious about the platform's longevity ever since they launched in October since you can find secondhand Zara on every other platform and potentially at a less expensive price if you shop around. I love that Zara is bringing repair into the mainstream with this initiative and hope that this inspires other brands to kick off their own mending programs.